By: Yuliia Zabudska

When Amazon orders 100,000 electric delivery vans and New York City replaces diesel buses with battery-powered fleets, it’s clear that fleet electrification is no longer a distant future. Fleet electric vehicles are a new reality, with governments tightening emissions regulations and companies seizing the financial and reputational edge of going electric.

The momentum is indisputable — now let’s consider what forces are driving this shift and explore the challenges behind the trend and real-life industry case studies.

Fleet Electrification as an EV Trend

Fleet electrification marks a major shift as businesses and governments are moving from gasoline and diesel-powered vehicles to EVs. The trend relates to various types of transportation, including smaller vehicles like two- and three-wheelers, medium-, and heavy-duty trucks.

Think of it as rewiring the nervous system of global transportation. The logistics, public services, shared mobility, and delivery vehicles that form the backbone of transport operations are gradually becoming powered by electricity rather than gasoline or diesel.

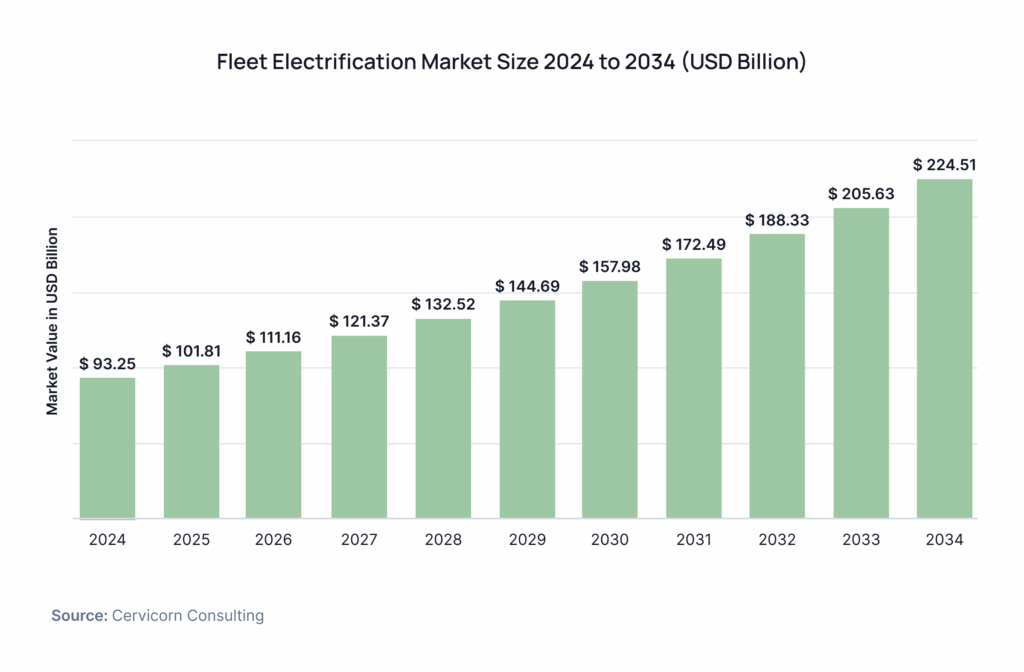

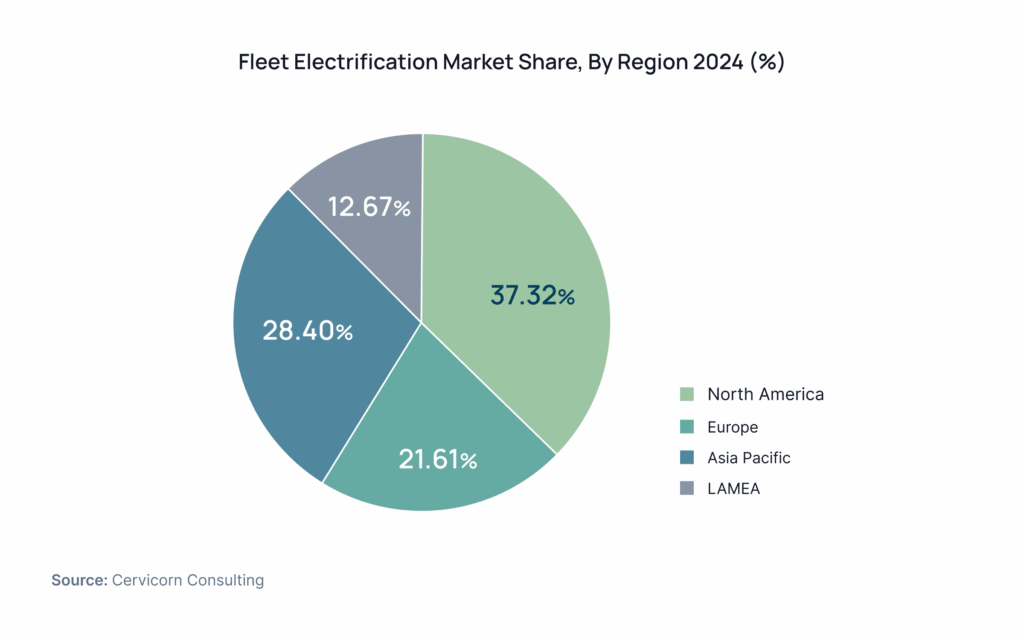

And the pace? Impressive. The 2025 EV fleet conversion survey found that 64% of fleet operators already run electric vehicles, and 87% of them plan significant electrification within the next five years. The global fleet electrification market itself was valued at $93 billion in 2024 and is projected to more than double over the next decade, reaching approximately $224 billion by 2034.

By region, North America is leading the fleet electrification market, with $83 billion projected market growth by 2034. At the same time, Europe, Asia-Pacific, and LAMEA (Latin America and the Middle East and Africa) markets do not lag behind.

On the vehicle side, global EV sales reached 17 million units in 2024 and are projected to reach 40 million by 2030. The global EV Outlook 2024 by the International Energy Agency (IEA) makes even more promising projections and reports about half of all cars sold globally to be electrified by 2035, on condition that the charging infrastructure expands too.

Together, all these stats make one thing clear: fleet electrification is a worldwide trend that’s becoming the baseline for modern fleets. The only question left is what’s driving this rapid transition — and that’s where we turn next.

Want to know more about EV tech trends for 2030? Explore this white paper. – https://intelliarts.com/blog/e-mobility-technology-trends/

Drivers Behind Fleet Electrification

As fleets across the globe go electric, three primary forces are pushing this trend forward: economic benefits, evolving policy regulations, and reputational and ESG (Environmental, Social, and Governance) factors. Below, we explore the impact of each.

Financial Benefits

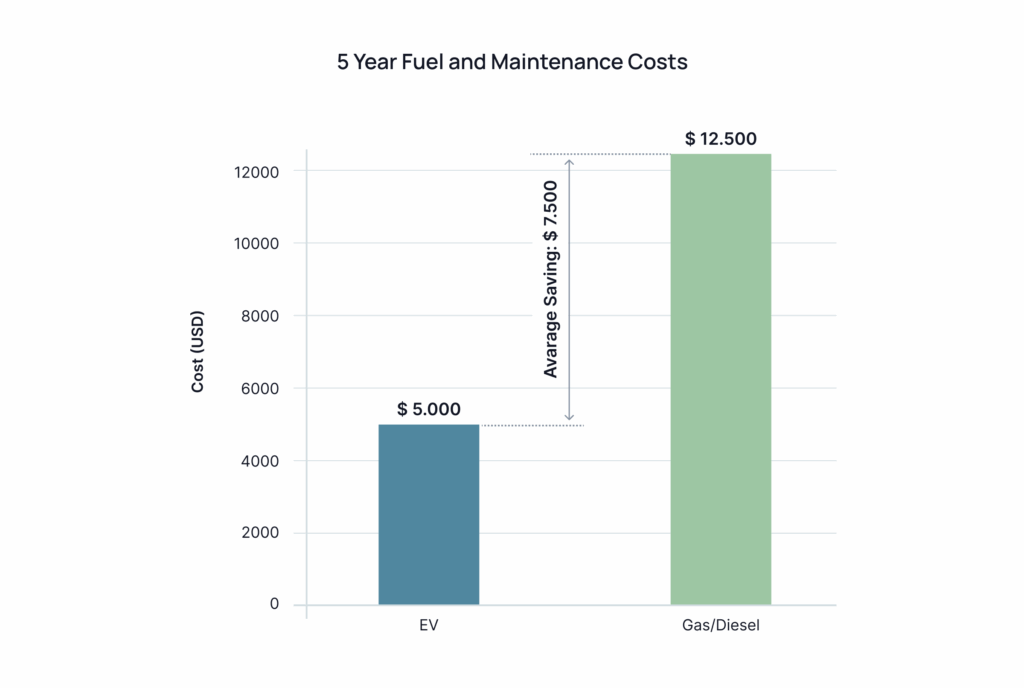

Electricity is usually much cheaper than diesel or gasoline on a per-mile basis. Vincentric’s 2025 Electric Vehicle Cost of Ownership Analysis showed that every one of the 54 EV models studied had lower electricity expenses than comparable gasoline vehicles. This translated into average fuel savings of more than $7,500 over a five-year period.

But there is more to it. EVs are much cheaper for maintenance, with fewer moving parts, such as no oil changes, fewer filters, and reduced brake wear thanks to regenerative braking. This means reduced service downtime and lower parts costs over time.

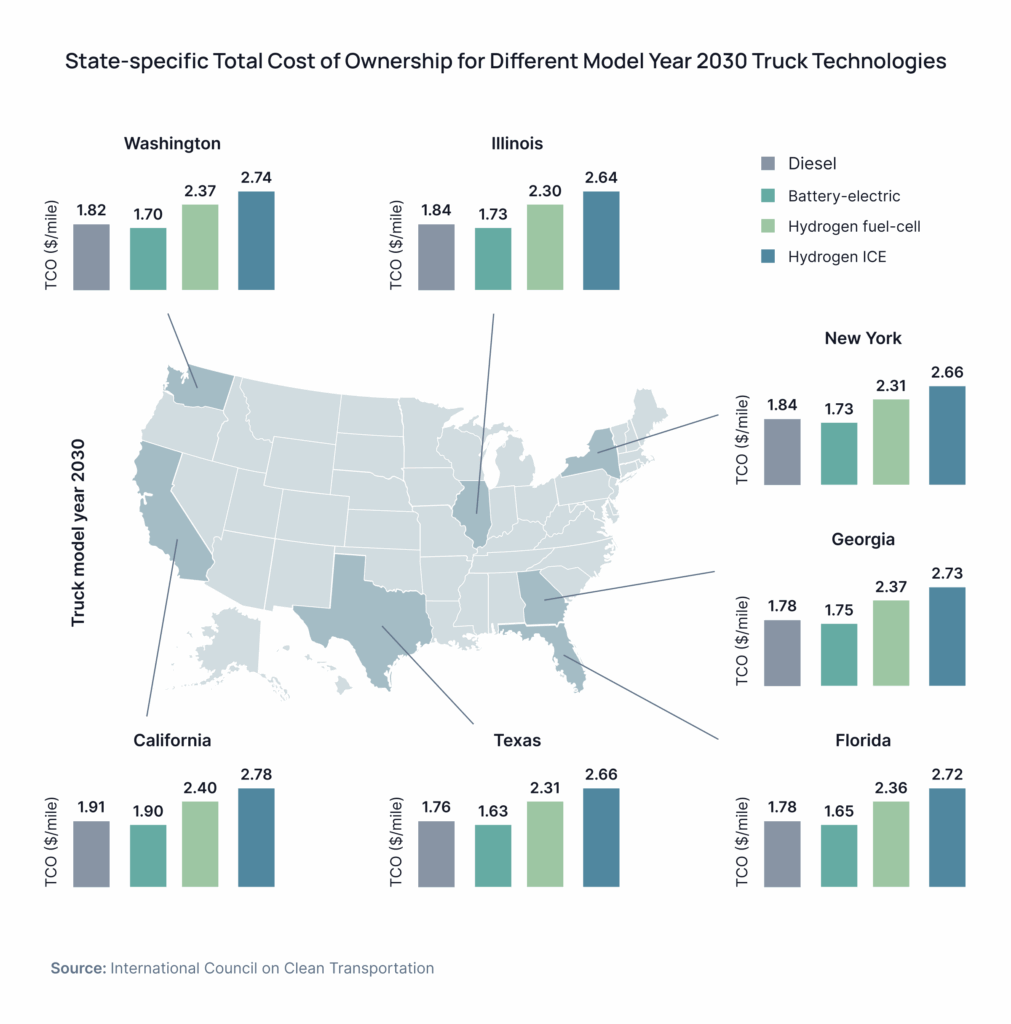

In the big picture, EVs are already breaking even or outperforming diesel in total cost of ownership (TCO) over 5 to 7 years for many urban and delivery and transit routes. Studies suggest that battery electric trucks only need to offer 15% lower fuel and maintenance costs to match diesel thresholds.

Add government incentives and perks, and the equation becomes even stronger. For example, Germany offers an environmental bonus of €4,000 for all-electric vehicles, while in the United States, buyers can benefit from federal tax credits of up to $7,500 on qualifying new EVs. Some countries, such as Norway or Lithuania, also propose non-monetary benefits like reduced parking fees or bus-lane access.

Policy and Regulation

If we go on with governmental support, we should mention that policies are one of the strongest accelerators of fleet electrification today. Here are a few relevant examples:

- EPA’s Clean Heavy-Duty Vehicles Program dedicates $1 billion annually to replace diesel trucks, with 70% of the investments for school buses

- The EU’s Alternative Fuels Infrastructure Regulation (AFIR) promotes public charging stations at least every 60 km on major highways for developing alternative fuel infrastructure across the EU

- The UK grants a 35% discount for an electric van’s purchase, with a maximum amount of £2,500 for small vans and £5,000 for large ones

- Corporate Sustainability Reporting Directive (CSRD) requires EU companies to disclose their environmental and social impact. As a result, many companies have taken on initiatives to fully electrify their fleets by 2030-2035, including a large German telecom that’s converting its 19,000 vehicle fleet

Reputation and ESG Factors

In a world where brands are judged by what they do, not just what they say, electrification sends a strong message. Going electric signals customers and consumers about a strong commitment to sustainability, which resonates with today’s audiences.

Sustainability achievements also often translate into valuable PR opportunities, as stories about companies reducing emissions and investing in green technology are selling well to media and stakeholders.

Last but not least, electrification supports ESG goals. This can work as evidence of compliance and credibility for businesses that report to regulators and investors.

“ESG makes good business sense. We’ve seen how climate change and other socioeconomic challenges intersect, which is why we’re leading global conversations and delivering innovative solutions that will create a more sustainable, equitable, and inclusive world.” — Carol B. Tomé, CEO at UPS

Real-world examples illustrate the reputational power of electrification. Uber Freight has teamed up with Tesla to launch the EV Fleet Accelerator Program, the idea of which was to help carriers overcome upfront cost and infrastructure barriers to electrification. By making electric fleets more accessible and affordable, the program accelerates the adoption of EVs across supply chains, as well as positions Uber as a visible leader in the decarbonization of logistics. Again, this message resonates strongly with investors, shippers, and customers under today’s increasing ESG scrutiny.

Another example includes the German logistics company, DHL Group, which decided to partner with Ford Pro to expand its electric fleet with 2400 new all-electric vans. This step is part of wider DHL’s strategy to increase the EV share of its delivery vehicles to over 66% by 2030 and ultimately reach zero greenhouse gas emissions by 2025. Beyond the operational efficiencies, these milestones add to the vision of DHL as a global leader in sustainable logistics and give the brand a clear competitive edge in the industry.

Barriers to EV Fleet Adoption

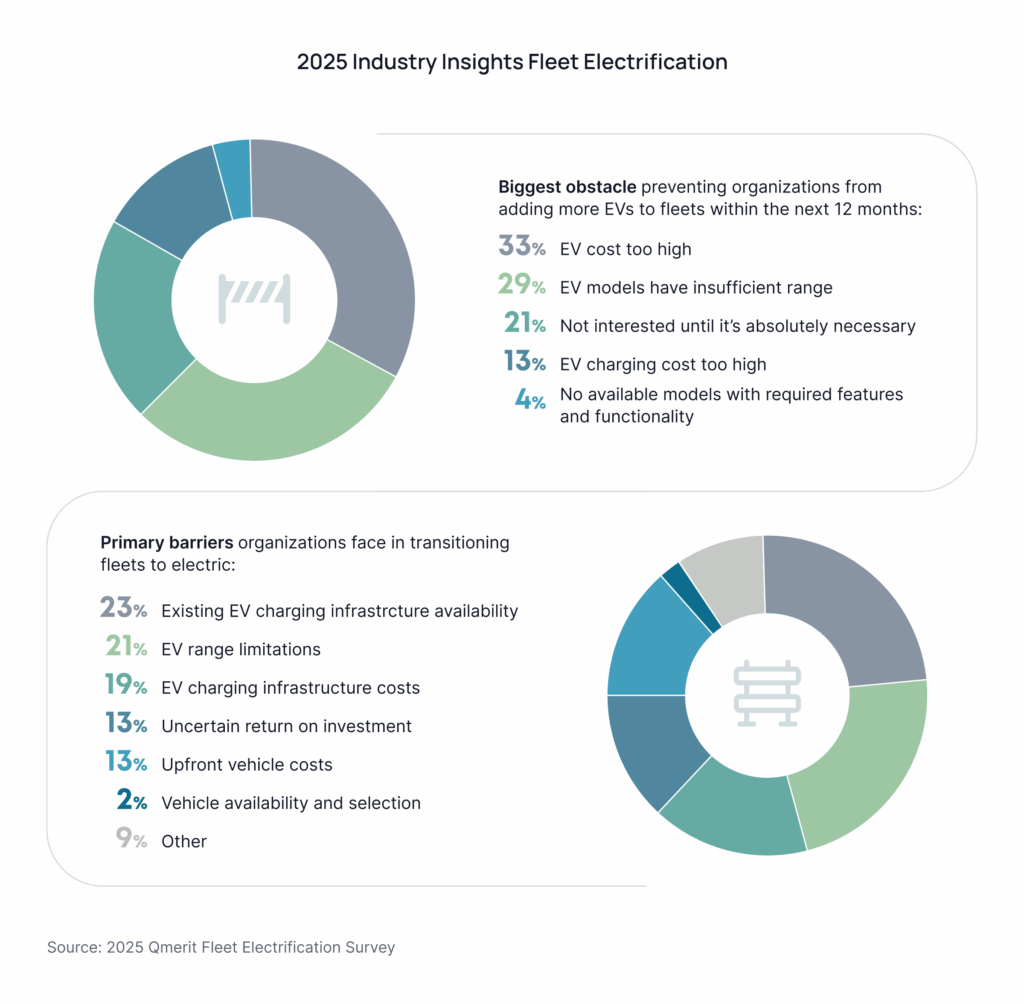

Businesses and governments are actively electrifying fleets. But the pace of electrification could be even more productive unless operational and technological challenges on the way:

- Charging infrastructure gaps: While EV availability has improved over recent years, charging infrastructure remains one of the major challenges in the industry, particularly for fleet-at-home and depot charging models. The survey at Expo 2025 states about grid constraints, delays in permitting, and inconsistent development of hardware and support services as the most common concerns.

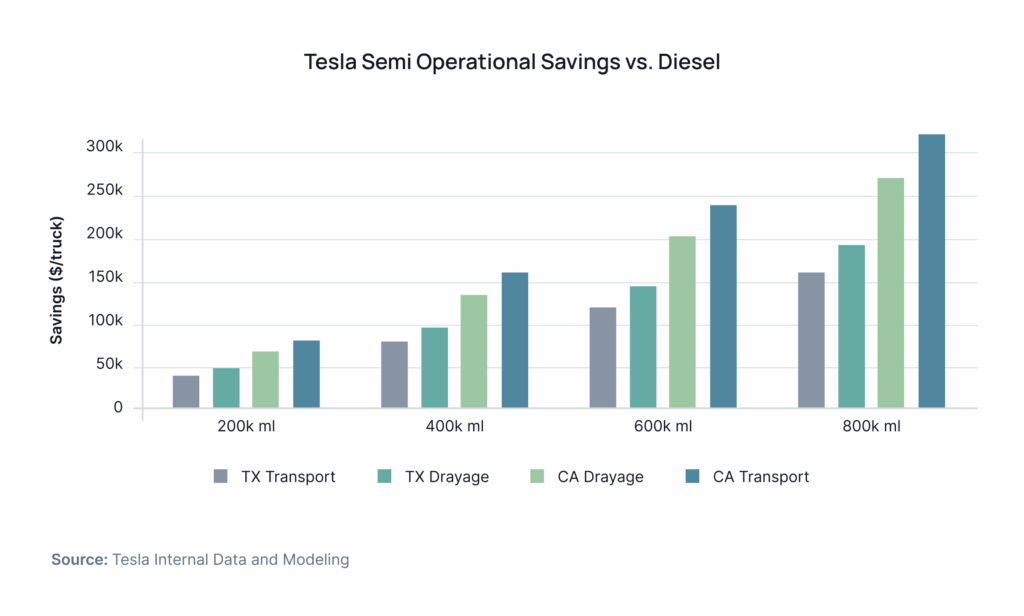

- High upfront costs: EVs guarantee long-term savings, but the upfront costs remain a barrier to adoption. In the US, zero-emission Class 8 trucks currently cost around $435 thousand, as compared to the $155 thousand price of similar diesel models. At the same time, the TCO diesel studies prove that over time, electric trucks usually outpace their diesel counterparts. By 2030, battery-electric trucks are projected to deliver lower TCO across many states thanks to lower energy and maintenance expenses.

- Range and operational limits: Depot charging works well for local routes. But the longer the routes, the more trucking depends on an underdeveloped public network. Megawatt charging systems (MCS) are promising but not yet widely deployed.

- Maintenance: On one side, EV fleets allow to save costs on maintenance due to limited moving parts. On the other side, high-voltage systems may require specialized training and tools, which adds extra costs for fleets in the short term.

- Uncertainty: Unfortunately, some operators associate fleet electrification with uncertainty. And this is for a reason if we consider changing government policies, such as the US IRA ending for new and used vehicles acquired after September, 2025, or unclear sales values.

Despite these hurdles, many companies are already proving that fleet electrification is both feasible and rewarding. Let’s review these real-life case studies and industry examples to see their results.

Real-World Case Studies in Fleet Electrification

While policies and economics set the stage, real value comes from businesses and governments that are already proving what electrification looks like in practice. Their experiences highlight both the opportunities and the challenges of the transition, including scaling infrastructure and long-term cost savings.

Amazon

Amazon is known as one of the pioneers of fleet electrification. The company has already deployed more than 25,000 custom electric vans across the U.S., supported by 32,000 chargers at 180 delivery stations. Their ultimate goal is to achieve at least 100,000 electric delivery vans on the road by 2030 to build a greener procurement network. For logistics giants like Amazon, going electric is both a long-term cost strategy and a reputational win, even though they have to deal with logistical issues, particularly in ensuring robust charging infrastructure.

“We want every customer to experience reliable and fast delivery, regardless of the changes we’re making behind the scenes.” — Kara Hurst, Chief Sustainability Officer at Amazon

Shenzhen

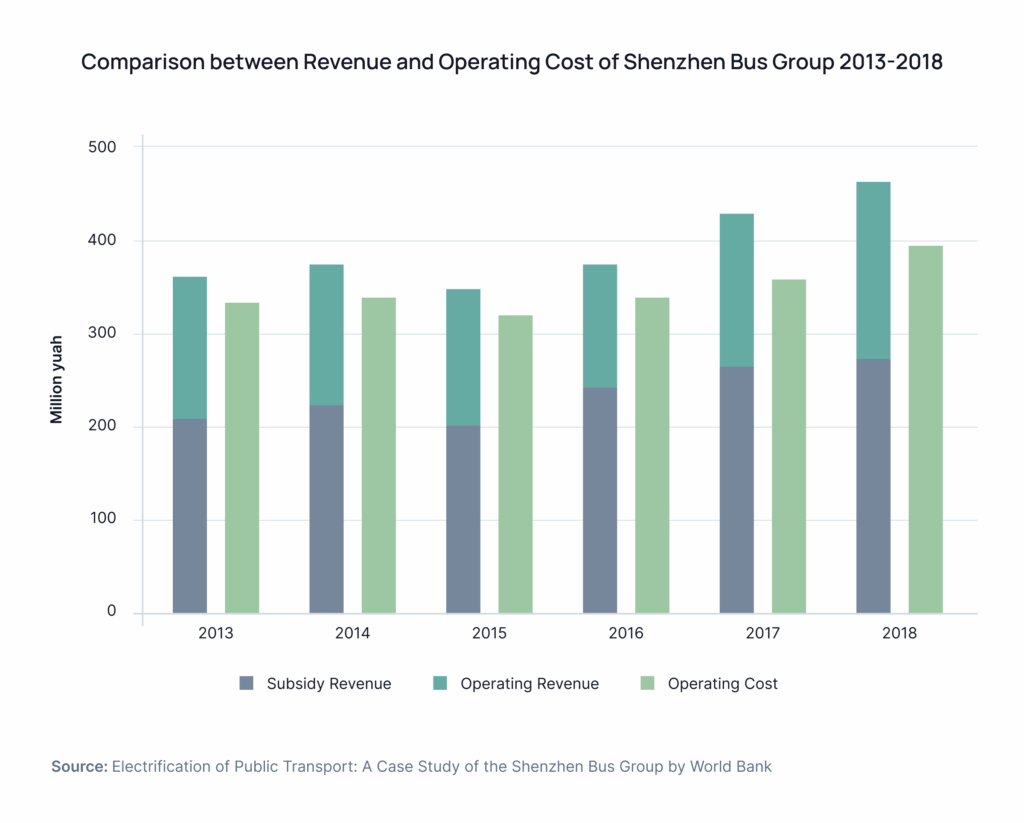

The case of Shenzhen is truly interesting from the point of fleet electrification. With strong governmental support, it was the first city in the world that managed to fully electrify its urban transit fleet of 16 thousand EV buses back in 2017.

Additionally, the Chinese city is working on electrifying its taxi fleet of 21 thousand vehicles, as well as garbage trucks and other heavy-duty vehicles. These changes are already paying off, with emissions from e-buses reported to be lower by 52% as compared to diesel ones. At the same time, the government has also reported massive investments in depot charging and grid upgrades.

Discover more about optimizing public transportation via EV fleet management.

Volvo and DSV

In 2024, logistics provider DSV placed an order for 300 electric trucks from Volvo. This deal marked one of Europe’s largest e-truck commitments and signaled the shift to electrification by commercial operators. It meant even more for the heavy-duty segment, where costs and range have traditionally created challenges.

Danfoss

The Denmark industrial manufacturer went even further and introduced Volvo e-trucks into 24-hour operations. Since heavy trucks are responsible for heavy CO2 emissions, this initiative is expected to cut emissions by at least 10–15%. What’s more, this particular case proved that electric trucks can easily match diesel in uptime and reliability, with the right charging and planning.

Source: Danfoss.com

Intelliarts Fleet Management

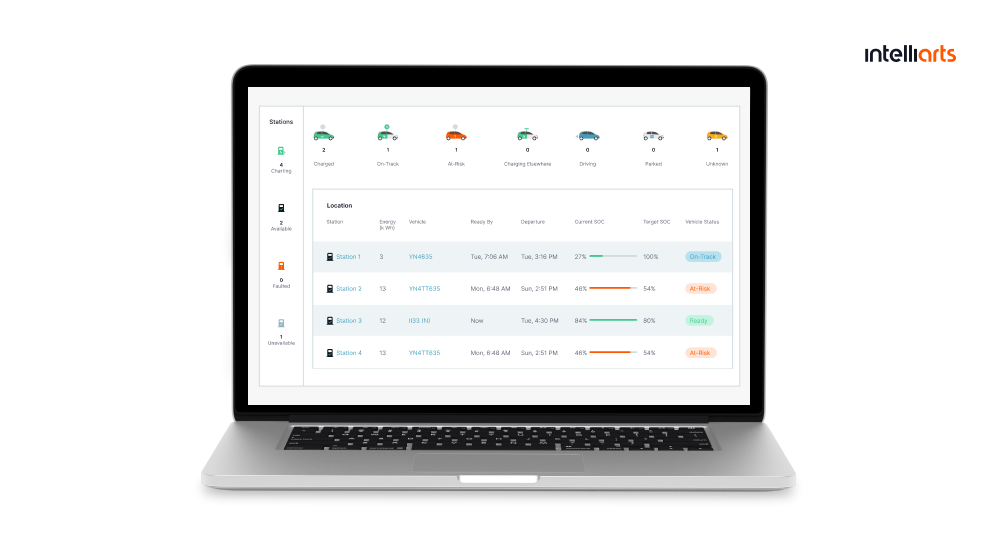

That being said, vehicles are only part of the story. Without smart software, electrified fleets risk inefficiencies, higher costs, and downtime. Alternatively, as proven by Intelliarts, smart platforms can help operators optimize charging schedules and manage grid demand effectively.

In one case study, Intelliarts partnered with EV Connect to develop a fleet management solution that covers all the top EV fleet use cases, including real-life charging and EV statuses, energy management, and reports and billing. As a result, the system managed to reduce downtime and lower operating expenses by shifting charging to off-peak hours and ensuring vehicles are ready when needed.

Wrap Up: What’s Next

By 2030, McKinsey projects that global EV sales will grow to about 40 million units annually, with fleets representing one of the fastest-growing segments. This rapid development is reinforced by innovations like vehicle-to-grid and hydrogen fuel cells, which together will help overcome infrastructure gaps and extend the range of viable use cases.

For businesses, the challenges include regulatory complexity, high upfront costs, and operational change. Still, the opportunity is far greater, and those companies that invest now in both EVs and the digital infrastructure to manage them will likely cut long-term costs, strengthen their ESG standing, and attract customers. The mobility transition is underway, and those who start planning today will definitely be the ones leading it tomorrow.

About Yullia Zabudska

Yullia Zabudska is an E-Mobility Solution Expert at Intelliarts with vast domain expertise and over 8 years of experience in software development. She specializes in EV charging, fleet management, and V2G and combines deep technical expertise with a passion for innovation to help e-mobility businesses optimize their operations.